WHAT WE DO

our expertize & focus

GST

Goods & Service Tax (GST) is a destination based consumption tax. It is a single tax in lieu of multiple taxes with a dual levy…

Customs

The process of importing goods into India and exporting goods out of India still remains complex due to various processes…

Income Tax

The Income Tax Act 1961 and the Income Tax Rules 1962, Notification and circulars issued by CBDT govern the levy & collection of Income Tax.

FEMA / PMLA

The Foreign Exchange Management Act 1999 (FEMA) regulate the foreign exchange market & transactions in India.

FTP

Foreign trade consists of import and export of goods and services resulting into outflow & inflow of foreign exchange.

SEZ

The Special Economic Zone Act 2005 and the SEZ Rules 2006 came into effect on 10th Feb 2006. The main objectives of the SEZ Act…

IPR

India is a signatory to the World Trade Organization (WTO). One of the WTO Agreements among the member countries…

Indirect Taxes

The goods and services Tax (GST) was introduced w.e.f. 01-07-2017 replacing the earlier indirect taxes viz.

About Tax Macs

Tax Macs was promoted with an objective of providing an integrated tax management and dispute resolution solutions on both direct and indirect taxes to every individuals, manufactures, service providers, traders, Importers / Exporters, Government departments, PSUs, and every business establishment dealing with Income, Goods & Services.

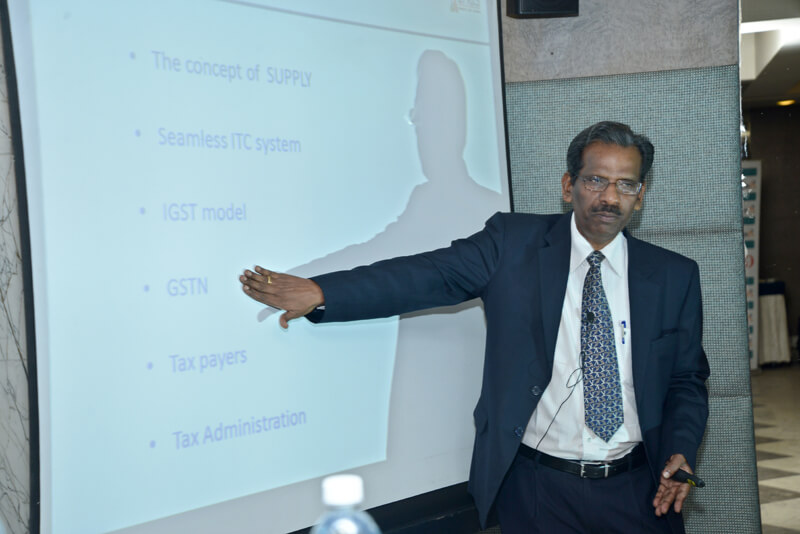

Shri. M. Ponnuswamy, IRS

Joined IRS (C&CE) in the year 1983 and held various positions in the Customs, Central Excise & Service Tax departments including the charges of Commissioner at Hyderabad, Chennai, Bangalore & Visakhapatnam.